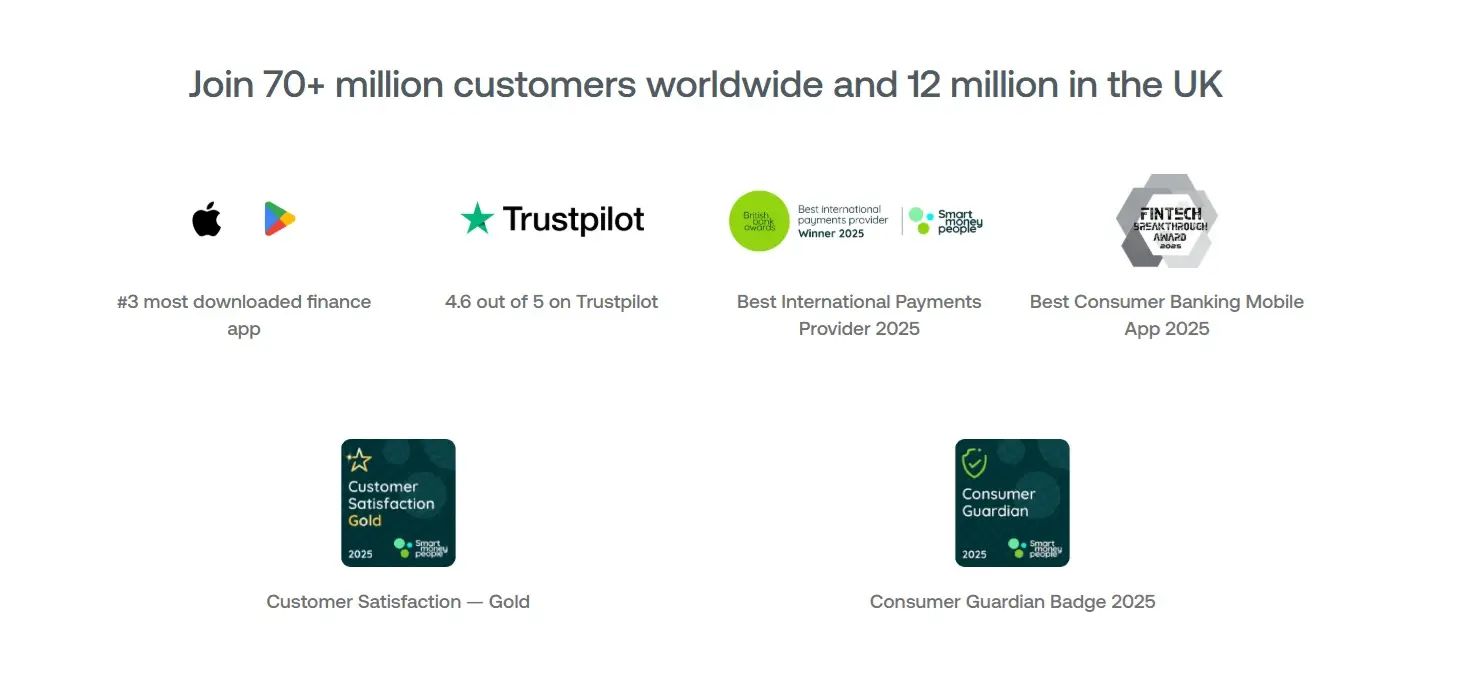

Revolut disrupted the market as a travel card that allowed currency exchange without hidden fees, challenging the opacity of traditional banking. Since its founding in London, its journey has been a lightning-fast expansion into a global financial super-app covering everything from current accounts and international transfers to stock and crypto investments for tens of millions of customers.

The story of Revolut is one of relentless pursuit of efficiency and constant innovation, launching products at a speed few banks can match. By centralizing all financial needs in one place, they have made moving, spending, and saving money a digital-native experience, tailored to a global lifestyle that prioritizes total control from a mobile device.

Users seeking cross-border financial tools often compare Revolut’s features with the specialized international transfer services of Wise or the credit flexibility offered by Klarna.

Digital banking + payment app + multi-currency + global transfer + financial tools; fintech-first infrastructure

Unicorn / Late-stage private (among top fintech valuations globally)